Information and frequently asked questions about the Home Assistance Insurance

Services

- Emergency situation: Zurich organizes specialists to take the necessary immediate measures if damage occurs or if a claim lodged would increase without immediate action. Costs of up to CHF 1,000 are covered.

- Locksmith service when the insured person is not able to open the doors and gates of the insured premises. Costs of up to CHF 1,000 are covered.

- Assistance in case of malfunctions in heating, air-conditioning, ventilation, lift and sanitation systems and in the fuse box. Costs of up to CHF 1,000 are covered.

- Pipe-cleaning service when a waterpipe is blocked. Costs of up to CHF 1,000 are covered.

- Pest control service in the case of pests and vermin harmful to health (e.g. bed bugs, mice). Costs of up to CHF 5,000 are covered.

- Removal of bees’, hornets’ and wasps’ nests up to CHF 1,000.

Depending on the type of home and building, the premium is fixed per year. For a detached family home, for example, the annual premium is less than CHF 40 (including statutory charges such as stamp duties; any deductions such as the youth or combination discount are not included in this price).

Important exclusions

- Cost of replacement parts

- Damage to buildings and household contents

Our heater breaks down on a holiday. Is the emergency service still insured?

Of course – HomeAssistance is available 24 hours a day, 365 days a year, even at Easter or Christmas.

It snows all night long and in the morning a tree threatens to topple onto the building due to the snow load in the garden. This type of emergency is not directly mentioned in the GCI. Is it still insured?

Yes, because the HomeAssistance Service "Emergency Situation" is an all-risk coverage. All emergency situations (as defined in the GCI) that are not explicitly excluded are covered.

I lost the code card for our garden gate and now can't get into the property. Is this a case for HomeAssistance?

Yes, this type of emergency is covered under the keyword "locksmith". This not only refers to doors or gates inside or outside the house, the protection applies to the entire property.

I found small insects in the flour in my pantry. Is this a case for the pest control service?

We will cover costs of up to CHF 500 for identifying the insect (e.g. by using a photo). If the species is a health hazard, we will assume pest control costs up to a maximum of CHF 5,000.

The stairlift no longer moves. Is this also a case for HomeAssistance?

Yes, we will provide a professional to take care of it.

Downloads

Living guide

Neighborhood disputes: What you need to know now

Home Assistance: fast help for domestic emergencies

Carefree holidays anywhere in the world

Damaged a borrowed car – what now?

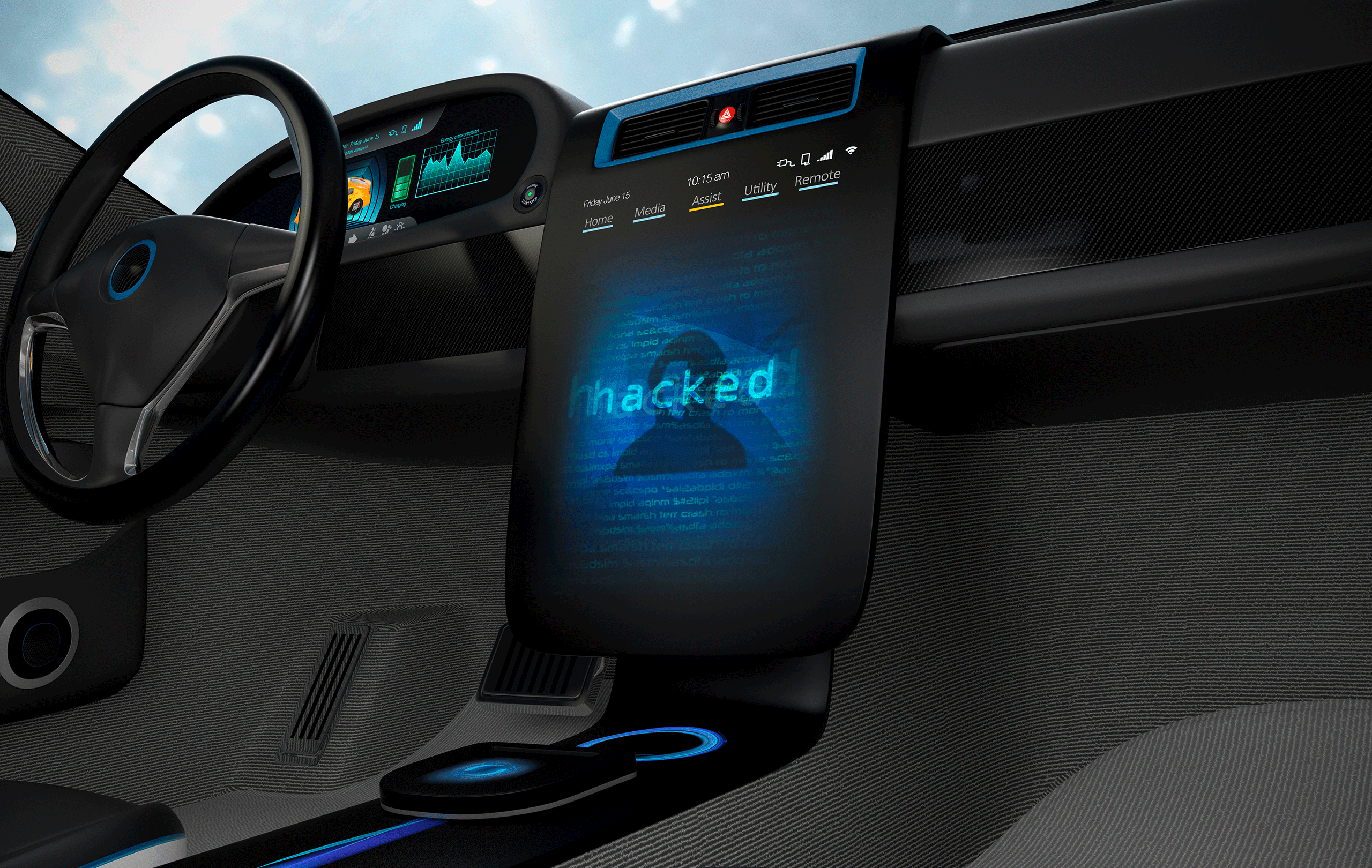

Cyber attacks on the car