What is underinsurance?

Underinsurance means that the agreed sum insured under your household contents insurance policy is not sufficient to replace all of your household contents at replacement value. In such a case, you may only be reimbursed for part of the damage.

What are the consequences of underinsurance?

If the actual value of your household contents is higher than the insured sum, there can be nasty surprises in the event of a loss. This is because insurance companies have the right to reduce benefits proportionately in the case of underinsurance. This can result in a considerable financial gap between the damage incurred and the actual compensation – so anyone aiming to save on premiums in this way is saving in the wrong place.

What are the specific effects of underinsurance?

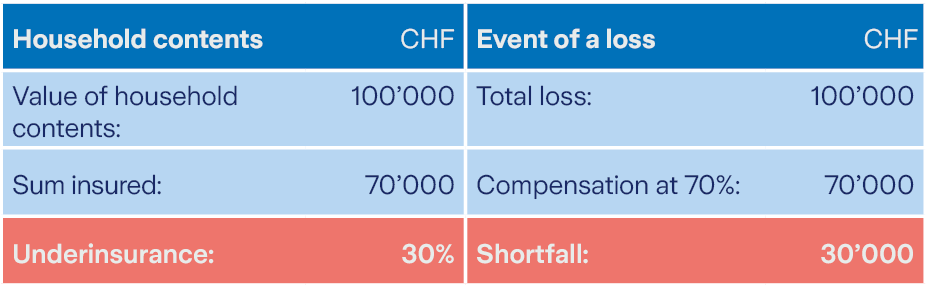

One example of the consequences of underinsurance: A house fire destroys all the household contents. The family owns household contents worth CHF 100,000, but only CHF 70,000 is insured. Accordingly, the insurance company only has to cover CHF 70,000 and thus 70% of the actual sum.

Are there also reductions for underinsurance in the event of a partial loss?

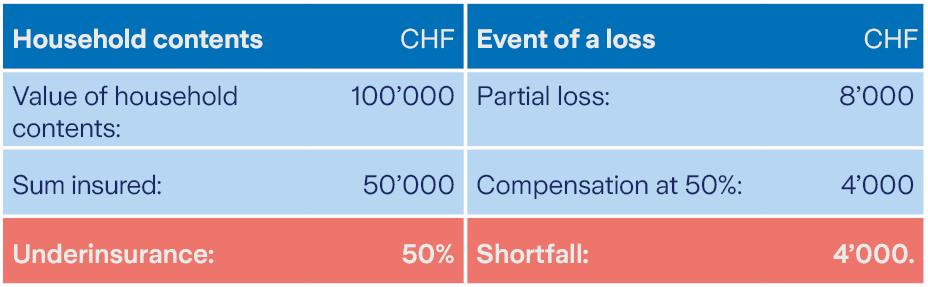

The deduction also applies in the event of partial loss, as the following example shows: The contract stipulates a sum insured of CHF 50,000, but the household contents are actually worth around CHF 100,000. Out of nowhere, a summer hailstorm sweeps in, damaging the outdoor seating, the oversized sun umbrella, and the barbecue on the terrace. This claim total is CHF 8,000. Because only half of the actual household contents are insured, the insurance company will only compensate 50% of the claim, i.e. CHF 4,000.

How generous is Zurich in the event of a loss?

In many cases, Zurich behaves more generously than required by law and waives reductions in benefits: As soon as you, the customer, accept the sum insured that our customer advisors propose based on the information you provide, we accept this sum and stipulate in the contract that there will be no reduction due to underinsurance in the event of a loss.

Are there exceptions to the waiver of underinsurance?

There are two exceptions in which Zurich cannot waive the underinsurance: If the damage is caused by a natural hazard such as hail, storm or flood, the underinsurance must be taken into account by law. As a customer, you would also be at a disadvantage in the event of a total loss: If you specify a sum insured that is too low, not all of your household contents are not covered – which in turn corresponds to a reduction. Ultimately, the goal must be to be able to replace the entire household contents on a new-for-old basis. At the same time, the sum must be realistic.

How can I protect myself against underinsurance?

Regularly check the agreed sum insured in your household contents insurance. Have you made any major purchases recently, for example, during the pandemic? Do you now work from home more often or have you started a new hobby? Has your professional or family situation changed? All of these can be reasons why the sums insured on household goods should be increased. It is therefore important to review them regularly – at least every five years – and update them if necessary.

What falls under household contents?

The term household contents covers all your home furnishings, including furniture, electrical appliances, crockery, clothes and books. Only things that are permanently attached to the house, such as a fitted kitchen, are not included. Of course, household contents also includes watches and jewelry, aids such as glasses, hearing aids or wheelchairs as well as musical instruments. The bicycles in the garage, the clothes box in the cellar and the ski equipment in the attic are also part of the household contents.