The gap between dreams and reality

Pillar 3a: Only one woman in two takes advantage of it

Investing in securities: Significantly higher long-term return potential than a savings account

In the long term, it is highly likely that the best returns will not be achieved in a savings account, but rather by investing in securities such as shares or funds. This is compellingly demonstrated by the following example:

Let's imagine that three friends had invested CHF 100,000 at the beginning of January 2004: The first deposits their money in a savings account, the second invests it in bonds denominated in Swiss francs and the third invests in an equity fund that tracks the Swiss Performance Index. The savings account develops slowly but steadily, the bonds have certain fluctuations. The equity fund is subject to greater fluctuations and can even lose value in the meantime, especially during the financial crisis in 2008 and the coronavirus crisis in 2020. Nevertheless, the investment in the equity fund has delivered by far the best return in the long term, as the three friends note: after twenty years, at the end of December 2023, there is CHF 122,000 in the savings account, the investment in bonds is now worth CHF 140,000 and the equity fund is worth CHF 366,000.

Investing to maximize returns? Only a minority do so

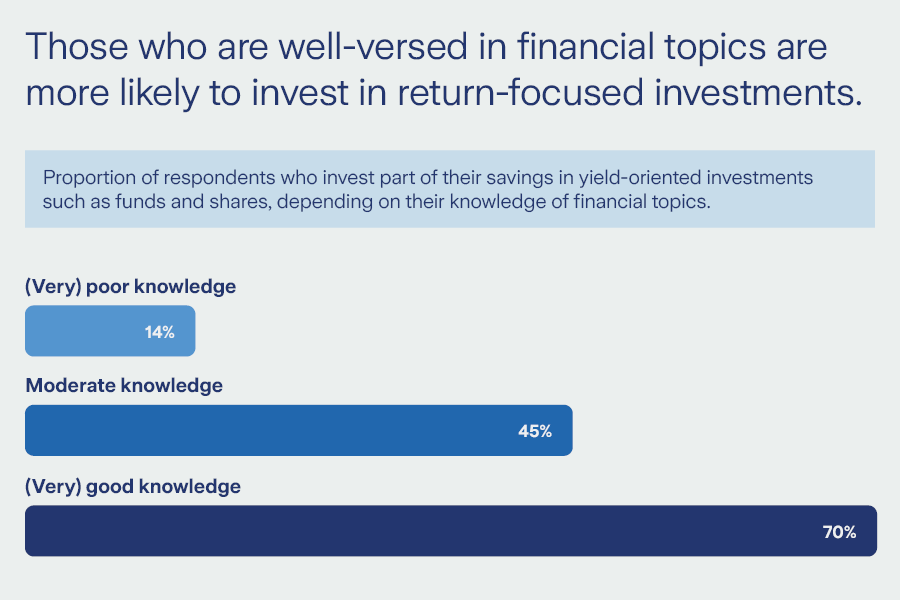

But in Switzerland, only a minority invest at least part of their private savings in investments such as shares or funds: According to the Fairplay Study, the figure is only 44%. Men invest more frequently in return-oriented investments than women, older people more frequently than younger people. The decisive factor, however, is financial knowledge: In the group of those who are well or very well-informed, 70% state that they invest with a focus on returns. Among people who rate their own knowledge as "poor" or "very poor", the figure is only 14% (see chart). This means: Knowledge is wealth. A lack of financial literacy leads to people making decisions without fully understanding the consequences – they may pay for this with a massively lower retirement capital.

The importance of knowledge is also evident in the gender difference: Men and women cite reasons such as risk or lack of savings as the reason for their reluctance to invest. However, women are significantly more likely to say that they lack the knowledge to invest more in return-focused investments.