- Without a last will and testament or inheritance contract: what Swiss inheritance law says

- Bequeathing with a last will and testament or an inheritance contract: Making use of leeway

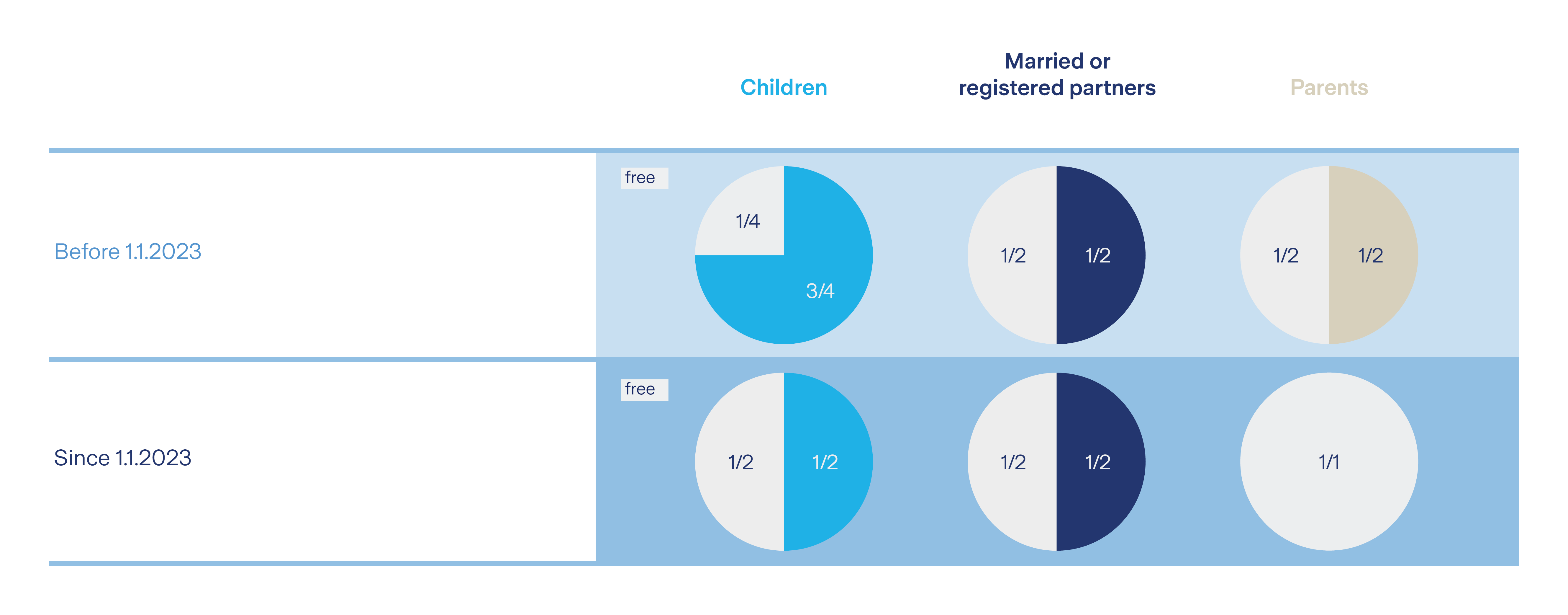

- Reduced mandatory portions since January 1, 2023

- Comparison of the old and the new compulsory portion regulations

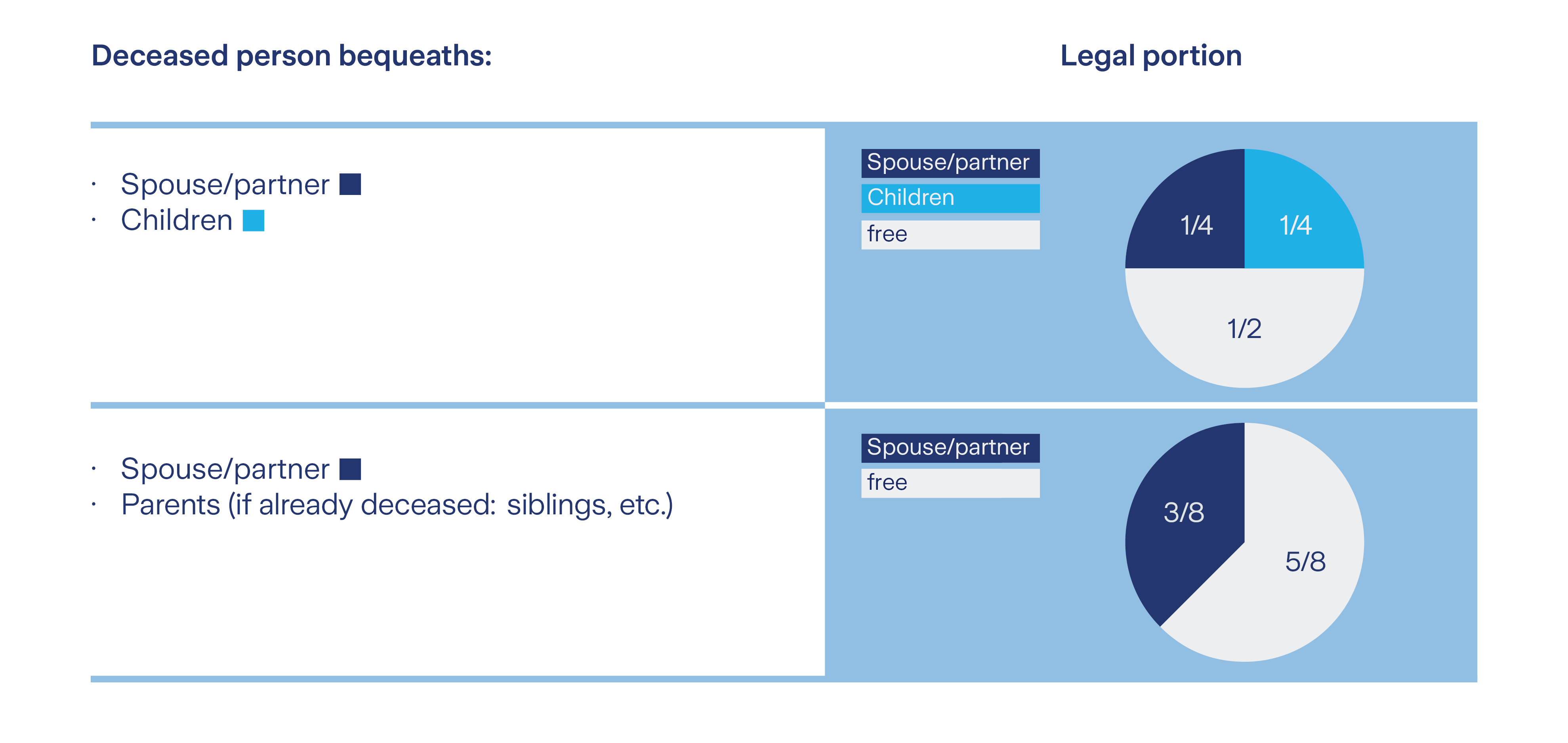

- Compulsory portions for married couples and couples in a registered partnership

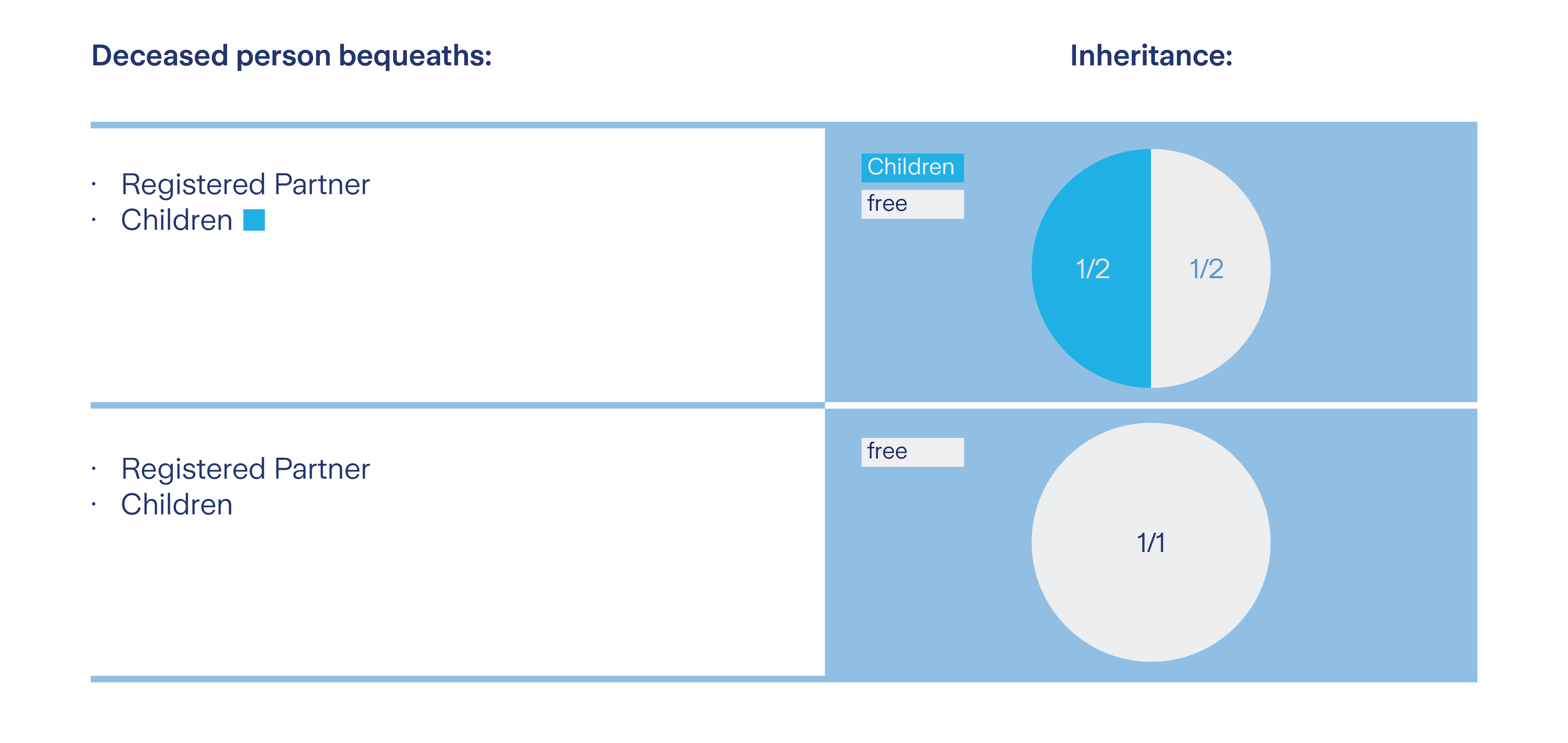

- No compulsory portion for people in a cohabiting relationship – the last will and testament can cover this

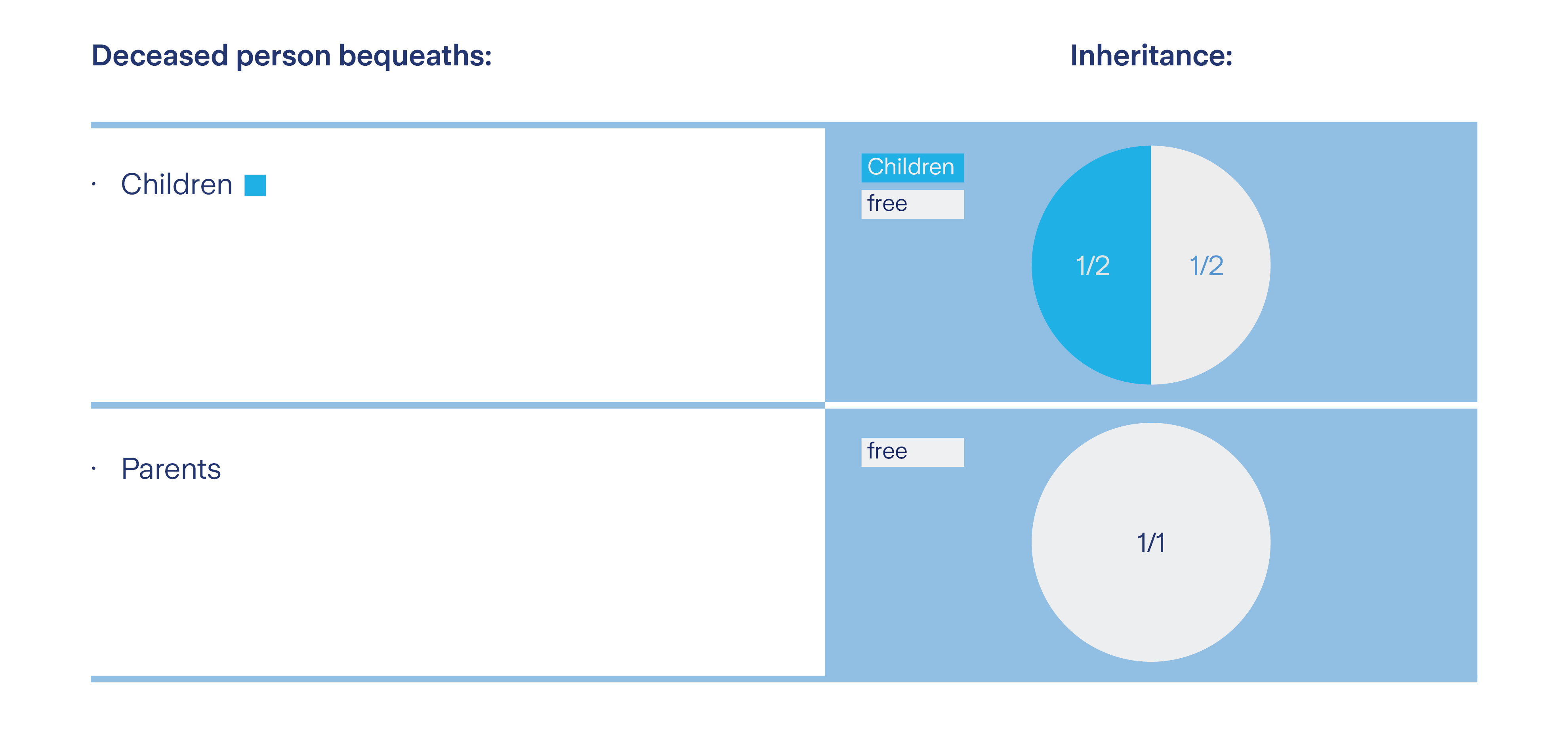

- The great freedom of single people – compulsory portion only for children

- Last will and testament settled before 2023? Check it now

- Frequently asked questions about inheritance – and our answers

Key facts at a glance

- If you have not written a last will and testament or an inheritance contract, the law determines how your inheritance will be distributed. Swiss inheritance law governs the relationship between the legal heirs, their claims to the estate and who will inherit how much.

- Since January 1, 2023, you have been able to distribute larger parts of your estate freely with a last will and testament or an inheritance contract. The compulsory portions – the protected parts of the inheritance for legal heirs – have been reduced or removed.

- If you have previously written a last will and testament, you should review it now. This will allow you to ensure that everything is implemented according to your wishes, even with the new regulations.

Without a last will and testament or inheritance contract: what Swiss inheritance law says

Around 70% of the Swiss population do not have a last will in the form of a last will and testament or an inheritance contract. In all of these cases, Swiss inheritance law determines what happens to the inheritance.

How the legal order of succession works

Legal heirs are: the registered partner or the spouse, the family members in a defined order and – in their absence – the canton or municipality of last residence. The closer a person was related to the deceased, the higher they are in the legal order of succession (parentelic system of succession).

The following applies:

- Although not related by blood, married, or registered partners always inherit. Cohabiting partners, on the other hand, have no legal claim to inheritance. Divorced partners are also not considered.

- In addition to the wife or husband, one's own children and their descendants have priority in the succession (1st in parental succession). As long as the children are minors, the surviving parent administers their inheritance. The proceeds may be used for the upkeep, upbringing, and education of the children.

- Second-order relatives (2nd in parental succession), such as parents and siblings, only inherit if there are neither children nor children's children. If one parent has already died, this part of the inheritance is passed on to the siblings. Without siblings, the remaining parent inherits everything.

- If there are neither parents nor siblings nor their descendants, third-order relatives (3rd in parental succession) such as cousins will inherit.

- In the absence of all the above, the inheritance Falls to the canton or commune of the last place of residence.

How an inheritance is distributed according to the law

Inheritance law also defines who among the legal heirs receives what share of the inheritance. These legal portions of the inheritance are calculated in fractions of the total inheritance:

- Married or registered partners receive at least 50% of the inheritance. If there are children, the other half of the inheritance is divided among them or their descendants. Without children, 75% goes to the partner and 25% to relatives (parents, siblings, etc.).

- If the deceased person was not married or living in a registered partnership but had children, they or their descendants inherit 100%.

- If the person had no children, the inheritance is divided in half between the parents of the deceased. If they are already deceased, the siblings will inherit; otherwise, nieces and nephews, etc. will inherit. If there are none of these either, their share of the inheritance goes to grandparents etc. If there are no living relatives, the entire inheritance goes to the canton or commune of the last place of residence.

Good to know

If you are married or live in a registered partnership, marital property law always takes precedence if your partner dies. As part of a so-called matrimonial property settlement, it is determined what belongs to the estate. Only the assets remaining in the estate are subject to inheritance law.

Bequeathing with a last will and testament or an inheritance contract: Making use of leeway

Around 30% of the Swiss population influence their inheritance with a last will and testament. With such a will or contract of inheritance, these persons also favor other persons and organizations in addition to their legal heirs. Or they change the legal distribution of their estate among the heirs. But beware: even with a last will and testament or an inheritance contract, not everything is allowed in a legacy. Inheritance law defines the minimum the heirs receive.

Reduced mandatory portions since January 1, 2023

Swiss inheritance law protects the inheritance of direct descendants as well as that of spouses and registered partners. In any case, they receive a certain share of the inheritance, the so-called compulsory portion. In principle, they cannot be excluded from the inheritance – unless they waive it themselves.

However, in the revised inheritance law, which has been in force since January 1, 2023, the compulsory portions have been reduced: those of a person's own descendants have become smaller, and compulsory portions of the parents have disappeared entirely. With a last will and testament or an inheritance contract, a larger part of the estate can now be freely distributed.

Comparison of the old and the new compulsory portion regulations

Compulsory portions for married couples and couples in a registered partnership

Patchwork families, for example, benefit from the new inheritance law. Thanks to the larger free portion, you can better take stepchildren into account in a will or an inheritance contract.

No compulsory portion for people in a cohabiting relationship – the last will and testament can cover this

More and more people are living together without a marriage certificate. But despite the revision of inheritance law, unmarried couples or couples who are not living in a registered partnership still have no statutory right of inheritance and no protected compulsory portion. If someone dies without leaving a last will and testament, the other person is left empty-handed in the inheritance. But thanks to the larger free portion, cohabiting partners can protect each other more generously in their last will and testaments or inheritance contracts.

The great freedom of single people – compulsory portion only for children

Like cohabiting couples, singles also enjoy a great deal of leeway when it comes to distributing the inheritance. Anyone who has no descendants of their own can freely inherit all their assets and favor people or organizations according to their own wishes.

Last will and testament settled before 2023? Check it now

If you made a binding last will and testament before 2023, you should review it again. Your last will and testament or inheritance contract is still valid, but the new law could lead to discussions. Because what does it mean now if your children were set to receive the compulsory portion in your will: the previous or the new share, i.e., three quarters of the statutory portion of the inheritance or only half? Clarify such questions so that your last will and testament is carried out according to your actual wishes. Because the new compulsory portions apply from January 1, 2023.

Good to know

With a term life insurance policy, you provide for your old age and can include benefits in case of disability and death. In the event of death, you have the option of giving financial consideration one or more individuals or an organization. With a written declaration in the contract of insurance or a letter to the insurer, you can determine who is to receive the sum insured or parts thereof. You can change this beneficiary at any time. In contrast to the often-lengthy inheritance process, the insurance company pays out the money immediately after the death certificate is presented. This might be important, for example, when it comes to continuation of a company.

Frequently asked questions about inheritance – and our answers

What is part of the inheritance?

What is the difference between a person's inheritance and the compulsory portion?

How does legal succession work?

Are my stepbrothers or stepsisters legally entitled to inherit?

What is matrimonial property settlement?

How do the three matrimonial property regimes differ when it comes to inheritance?

- Community of acquisitions: Under the community of acquisitions matrimonial property regime, the assets you have brought into the marriage remain in your possession. Even if you receive assets as a gift or inherit something as someone who is already married, it is yours alone. Anything else that has been acquired during the marriage belongs to both persons. If the partner dies, the joint property is halved. One half goes to the estate.

- Joint property: Irrespective of when assets were acquired or received as a gift, in marriage everything is fundamentally joint property. If one of the partners dies, his half is divided among the heirs – unless there is a different contractual agreement.

- Separation of property: If the couple has always strictly separated their property, in the event of death it is already clear who owns what and what is part of the inheritance. Matrimonial property separation ceases to apply.

What is the difference between a last will and testament and an inheritance contract?

Do I have to pay taxes on my inheritance?

With professional support from

As a technical expert at Zurich, he contributes his expertise in retirement provision and investments.