Three Pillars of the Pension System

The goal of Swiss retirement provision is that Switzerland's population be financially well prepared for all phases of life. This is why the Swiss pension system based on three pillars:

- state retirement provision (1st pillar)

- occupational retirement provision (2nd pillar)

- private retirement provision (3rd pillar)

That is why it is also known as the "3 pillars concept". The 3 pillars concept doesn't just benefit those who have retired: if you become unable to work or a close relative dies, the three pillars ensure that you remain financially secure. If you would like to find out more about the 3 pillars concept, please read our article "The three pillar concept: an overview of retirement provision".

Why is retirement planning important for you?

Financing the standard of living after retirement

Strategies and Tips for Retirement Planning in the 3 Pillars

First pillar: preventing gaps in OASI contributions

If you pay into the old-age and survivors' insurance (OASI) from the age of 21 up until your retirement without missing any contributions, your monthly OASI pension will amount to between CHF 1,260 and CHF 2,520. However, missing contribution years, known as "contribution gaps" can build up quickly if you do not pay the minimum annual contribution. This could occur in the following cases:

- if you study into your mid-20s and forgo employment during this time.

- If you have lived abroad for an extended period of time.

- If you have worked many jobs, each for only a short period of time. Wages below CHF 2,500 per employer and per year are exempt from contributions.

If you miss out on contributions for a year, your pension will fall by around 2.3%. You can close these contribution gaps retroactively. However, this can only be done for gaps that have accrued in the last five years.

Tip: check regularly to see if you have any contribution gaps in the OASI. To do this, request a statement from your account. You can obtain such a statement from your cantonal compensation office.

Good to know: in the case of married couples, the minimum OASI contribution is paid by the partner who is in paid employment. This means stay-at-home husbands or wives do not have to pay OASI contributions if their partner is in paid employment.

Second pillar: buying into the pension fund

If your financial position permits you to do so, you can top up your occupational retirement provision (BVG) by making voluntary contributions into your pension fund. In doing so, not only will you be saving for your old age, you will also reduce your tax burden. You can deduct the full amount the contribution from your taxable income. The best strategy here is to spread larger amounts over several years. This allows you to reduce your tax burden annually. The amount of additional contributions you can pay into the pension fund is dependent on your purchase potential. Your pension fund statement will tell you how large the purchase potential is.

Tip: Check to see if you can pay into the pension fund. Request an occupational retirement provision account statement.

Useful information for part-time workers

By law, you will only be enrolled in a pension fund if your annual salary exceeds CHF 22,680. Those whose working time is spread across multiple employers should be aware that, if you earn CHF 22,680 or above, but not with a single employer, you are not affiliated with a pension fund. However, you can still enroll yourself in the Substitute Occupational Benefit Institution. Depending on the pension fund regulations of your respective employers, you may also be able to enroll in one of these pension funds. Check with your employers for more information.

As a part-time employee, you should also take the coordination deduction into account. The coordination deduction is subtracted from the gross salary for the purposes of determining the insured salary. This amount is currently CHF 26,460 for full-time and part-time employees. This means: whether you earn CHF 120,000 or CHF 30,000 per year, your insured salary is calculated by subtracting CHF 26,460 from your gross salary. Many who work in part-time employment over long periods live on the subsistence level in their old age or are dependent on their partner.

Tip: discuss the coordination deduction with your employer. Some pension funds will accommodate their part-time employees and voluntarily adjust the deduction to the reduced level of employment.

Part-time work and pensions

Third pillar: make provisions for your retirement and reduce your tax burden with pillar 3a

There are many good reasons to pay into the third pillar. With regard to your retirement, you will benefit from making annual payments towards private retirement provision in order to build up your retirement capital. This allows you to reduce your tax burden annually; you can deduct the full amount that you pay in from your taxable income. In 2025, people who are enrolled in a pension fund are permitted to pay in CHF 7,258. Those without a pension fund are allowed to pay in 20% of their net income or a maximum of CHF 36,288. You can find more information in the article "Pillars 3a and 3b – an overview".

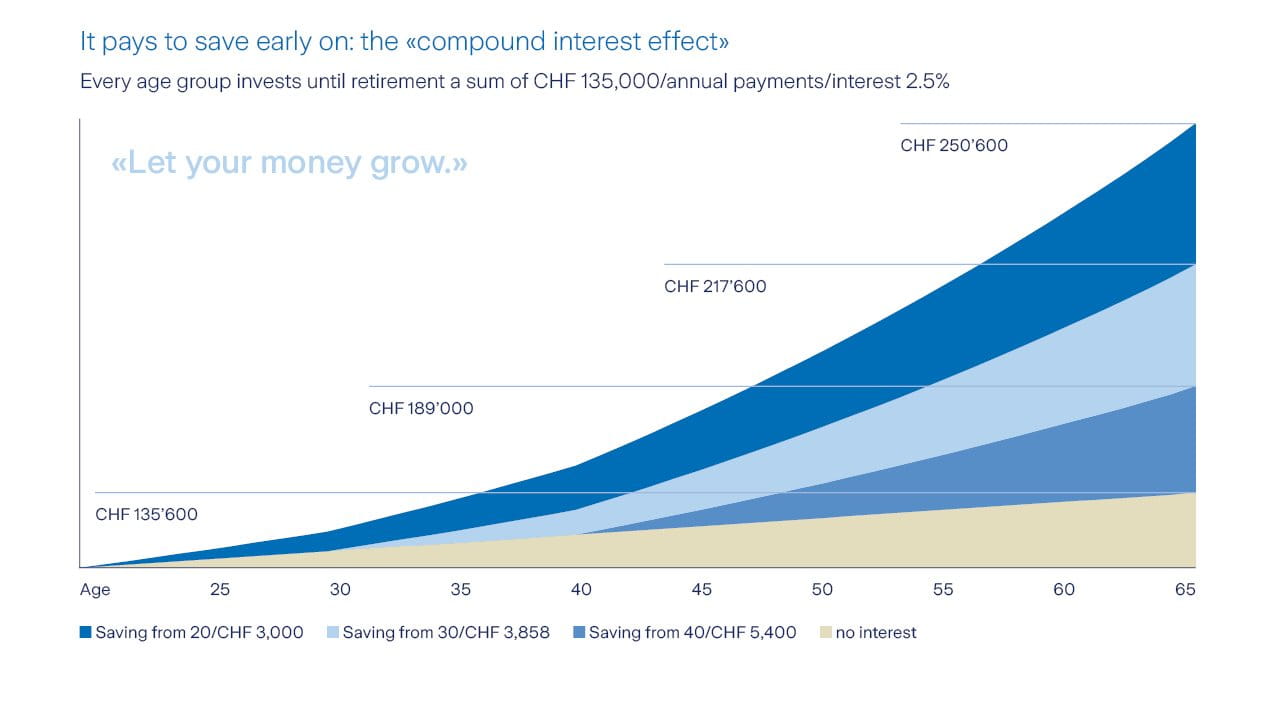

Tip: the earlier you begin to save for your old age, the more you will benefit from compound interest. Compound interest means interested paid on top of interest already earned.

How compound interest enhances private retirement provision

Pension development for person A

| Year | Initial capital in CHF | Interest (2.5%) | Final capital in CHF |

| 1 | 3’000 | 75 | 3’075 |

| 2 | 3’075 | 152 | 6’227 |

| 3 | 6’227 | 231 | 9’458 |

| ... | ... | ... | ... |

| 45 | 244’548 | 6’114 | 250’662 |

Example: Person A has paid CHF 3,000 per year towards their private retirement provision for 45 years. With regular returns of 2.5%, they have saved CHF 250,662 thanks to compound interest.

With professional support from

As a technical expert at Zurich, he contributes his expertise in retirement provision and investments.