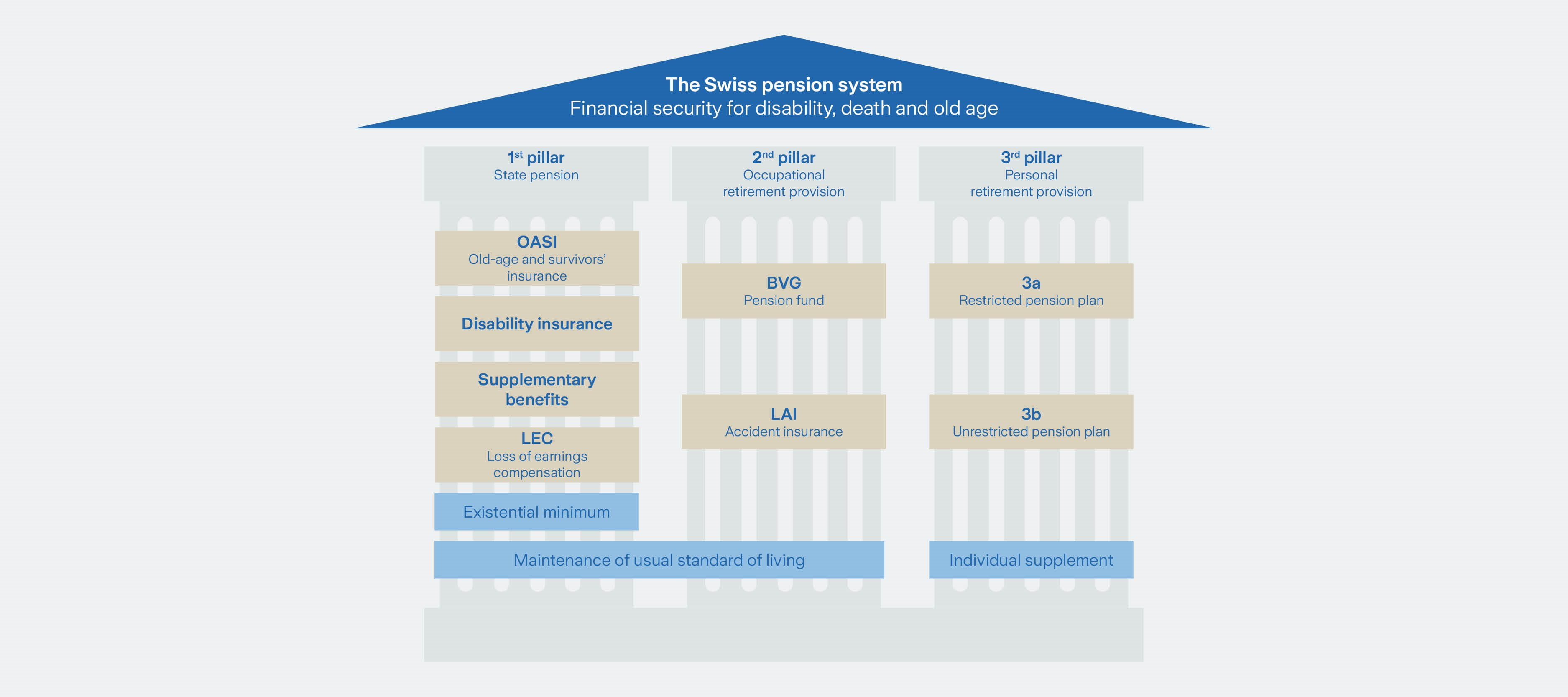

Three-pillar principle: the foundation of Swiss pension system

The Swiss pension system is designed to provide the insured with a reliable income for all situations in life. For example, after retirement, in the event of the death of a partner or in the event of permanent disability due to illness or accident.

The Swiss pension system is based on a three pillars concept. The state, employers and each individual person pays into the accounts that comprise these pillars. The three pillars concept ensures a high level of social security.

The three pillars explained briefly

1st pillar – state retirement provision

The 1st pillar consists of old-age and survivors' insurance (AHV or OASI), disability insurance (DI) and the income compensation scheme (EO). In this article we will only discuss the AHV part. The 1st pillar is about basic social security. The old-age and survivors' insurance (AHV or OASI) is a national insurance plans covering the entire population of Switzerland. Participation is mandatory as it represents the state pension insurance scheme. There is only one AHV administration; there are not multiple providers. Every person aged 18 or over who is gainfully employed in Switzerland automatically pays into the AHV system, starting in the year when they turn 18. Contributions are directly deducted from pay. Every person receives an AHV pension upon retirement. This pension is intended to cover the minimum necessary living requirements. The amounts paid out vary depending on how long you have paid in and how much you have earned. Given a full contribution period, the minimum pension for individuals is CHF 1,260 and the maximum pension is CHF 2,520. Married couples receive a maximum 150% of the maximum individual pension, i.e. a maximum of CHF 3,780.

You can find further information on this on our "1st pillar" overview page

2nd pillar – occupational retirement provision

The 2nd pillar consists of the occupational retirement provision scheme pursuant to the BVG. It is also called a pension fund (PF), and was originally intended to secure the standard of living that people were accustomed to. Today, however, this is almost no longer possible with AHV and PF alone. As part of occupational retirement provision, employees and employers pay into a pension fund. There are employee and employer contributions. There are different types of pension funds. Persons who work in Switzerland pay into the occupational retirement provision scheme starting at age 25 at the latest.

If you change jobs, you have to move the money in your pension fund to the pension fund of the new employer. To do so, you notify your old pension fund of the new pension fund so that the former can transfer the assets.

Before retirement you can choose whether you want to have the entire balance of your pension fund account paid out at once or receive a fixed amount as an annuity instead. It is also possible to draw a partial one-off lump sum and the rest as an annuity.

You can find further information on occupational retirement provision on our "2nd pillar" overview page.

3rd pillar – private retirement provision

The assets in the 3rd pillar serve to close any pension gaps left over from the 1st and 2nd pillars. The 3rd pillar consists of pillar 3a and pillar 3b. The third pillar is personal retirement provision, and is voluntary.

Pillar 3a

Pillar 3a is the so-called restricted personal retirement provision. The state promotes personal retirement provision, which means you can deduct paid-in contributions from your taxes. There is a maximum amount however, which may vary slightly from year to year. In 2025, employed persons with were able to pay in a maximum CHF 7,258 per year to their pension fund account. Employed persons without a pension fund account may pay in up to 20% of their net earned income, capped at CHF 36,288.

The credit balance (assets) from this pillar (account) is not freely available at all times. You will normally only receive your contributed funds once you retire. It therefore serves primarily to provide for retirement – hence the term "restricted pension provision".

There are three exceptional cases in which early payout is possible:

- You want to buy residential property

- You are becoming self-employed

- You are leaving Switzerland permanently

Pillar 3b

Pillar 3b is an unrestricted means of personal retirement provision that not subsidized by the state. Accordingly, your contribution payments are not tax-deductible. Everybody can pay into this pillar, and there is no maximum amount. The saved assets are not tied to retirement purposes. Therefore you are free to choose when you wish to draw money from the account. This is thus referred to as a free or unrestricted pension plan. However, you should only consider paying into pillar 3b once you have exhausted the maximum amount payable into pillar 3a.

You can find further information on the third pillar on our article Pillars 3a and 3b – an overview .

Is the 3rd pillar becoming increasingly important?

The first and second pillars usually cover up to 60% of your final salary. If you wish to maintain your accustomed standard of living in old age, you will either need a lot of private savings or assets from 3rd pillar retirement savings. Paying into the 3rd pillar as savings for your pension makes sense in many ways:

- The 3rd pillar has the greatest potential for directly influencing your pension capital. This is because you have the flexibility here to decide for yourself how much you want to pay in to achieve your personal savings goals.

- You can deduct the contributions you make from your taxes. This means that you can save on taxes with every amount you pay in. Even if you cannot afford to pay in the maximum contribution: Use this option instead of leaving the money in a regular bank account.

- The money from the 3rd pillar is and remains your own. What you pay in is yours. You decide whether and how you want to invest it.

These are the possibilities

You can open a pillar 3a account at a bank or an insurance company, for example. As a rule, an account, insurance or fund solution is chosen. A combination of the above is also possible.

For example, you can open our 3a retirement provision account quickly and easily online.

Our Premium Life savings insurance offers you the following advantages compared to an account-based solution:

- Security and returns: 95% of your savings premiums are guaranteed. At the same time, you get attractive potential for returns.

- Security for your family: You protect yourself and your loved ones from the financial consequences of disability or death. Because with savings insurance, we continue to pay into your pillar 3a restricted pension plan, even if you become disabled. You therefore continue to save for retirement even if you can no longer work.

- You remain flexible: You decide how much you want to save on a regular basis. And if something comes up in life, you can interrupt your premium payments for one to three years.

You can find further information on our page "Premium Life Savings Insurance".

With all of the given options: It pays to start paying into the third pillar as early as possible. Even small amounts can grow into a considerable sum over a longer period of time.

Are you unsure which solution is the best one for you? Our experts will be happy to help you.

With professional support from

As a technical expert at Zurich, he contributes his expertise in retirement provision and investments.