- People feel financially secure, but...

- Sickness and accidents threaten financial security

- Money does make you happy

- What retirees regret in retrospect

- Missed pension opportunities in the younger generation as well

- People who know what they are doing invest in shares

- Invested in shares? In retrospect, this is usually "just right"

Zurich has conducted the representative study for the 5th time together with the Sotomo 2025 research institute. Around 1,800 people in German- and French-speaking Switzerland were surveyed. These results are particularly interesting:

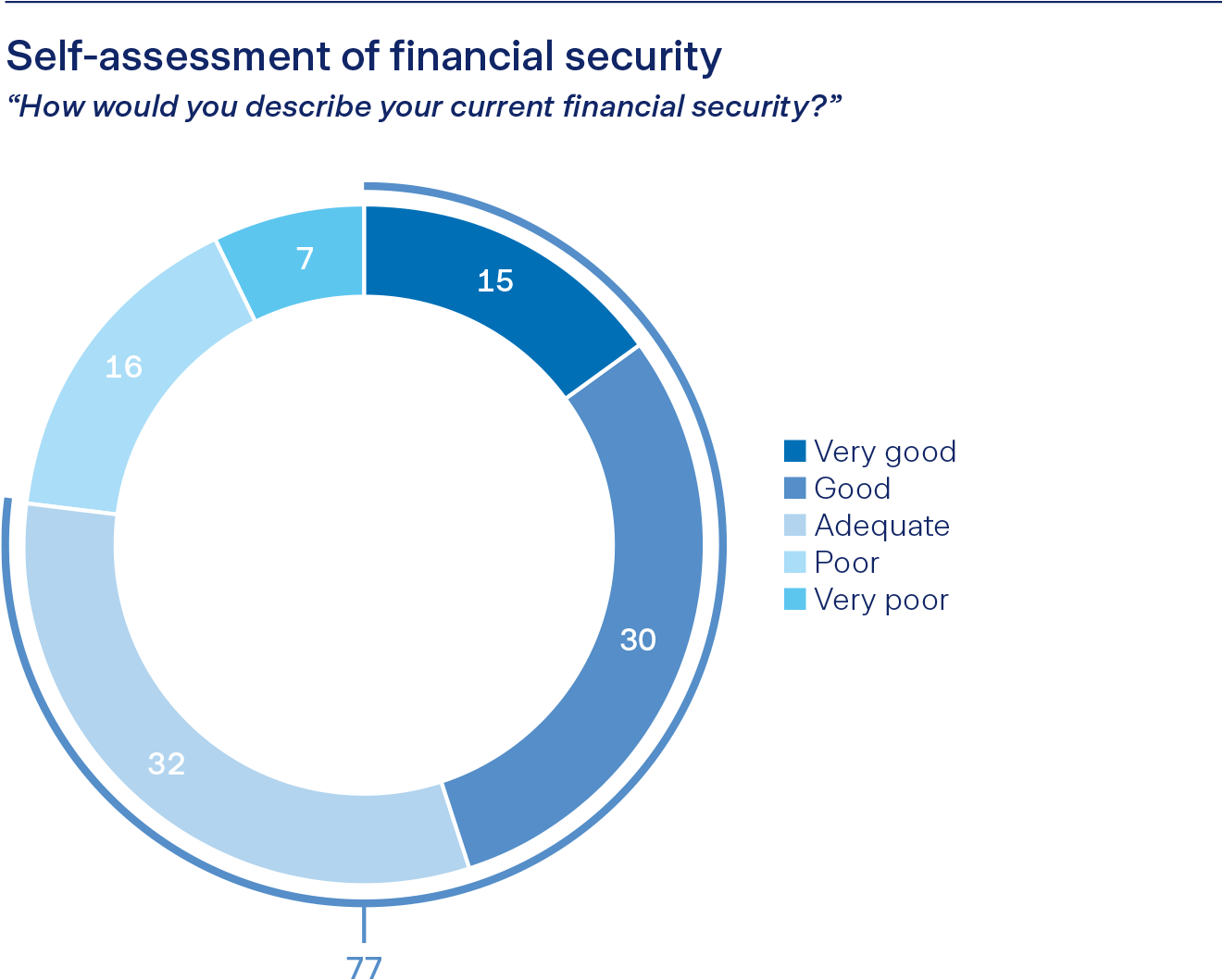

People feel financially secure, but...

People in Switzerland feel financially secure – 77 percent rate their current financial security as at least adequate. Among those over 65, the figure is even 93% – the lion's share of retirees has no financial worries. On average, respondents need CHF 19,600 in savings to feel secure in their current living situation, i.e. roughly four average monthly salaries. However, this sum can be very different for each individual and depends heavily on age, among other things.

Sickness and accidents threaten financial security

Nevertheless, this feeling of security is fragile: 46% of respondents cited "sickness and accidents" as the biggest threat to their financial security, ahead of health insurance premiums, unemployment, and rising rents or mortgage rates. Almost half of them are, therefore, concerned about the financial consequences of sickness and accidents. Possible causes of their concern are high deductibles for health insurance and the fear of loss of income due to disability.

Money does make you happy

Half of the people in Switzerland think about their finances at least once a week, and a good third of respondents (34%) have had money worries in the last year. This was the case for women more often than men (39% versus 29%) and for young people significantly more often than older people (50% versus 11%). These concerns are not without consequences: 39% of those affected sleep worse, 38% feel anxious and a quarter of them struggle with depression or irritability. Financial insecurity therefore affects not only the material quality of life but also emotional well-being, according to the study.

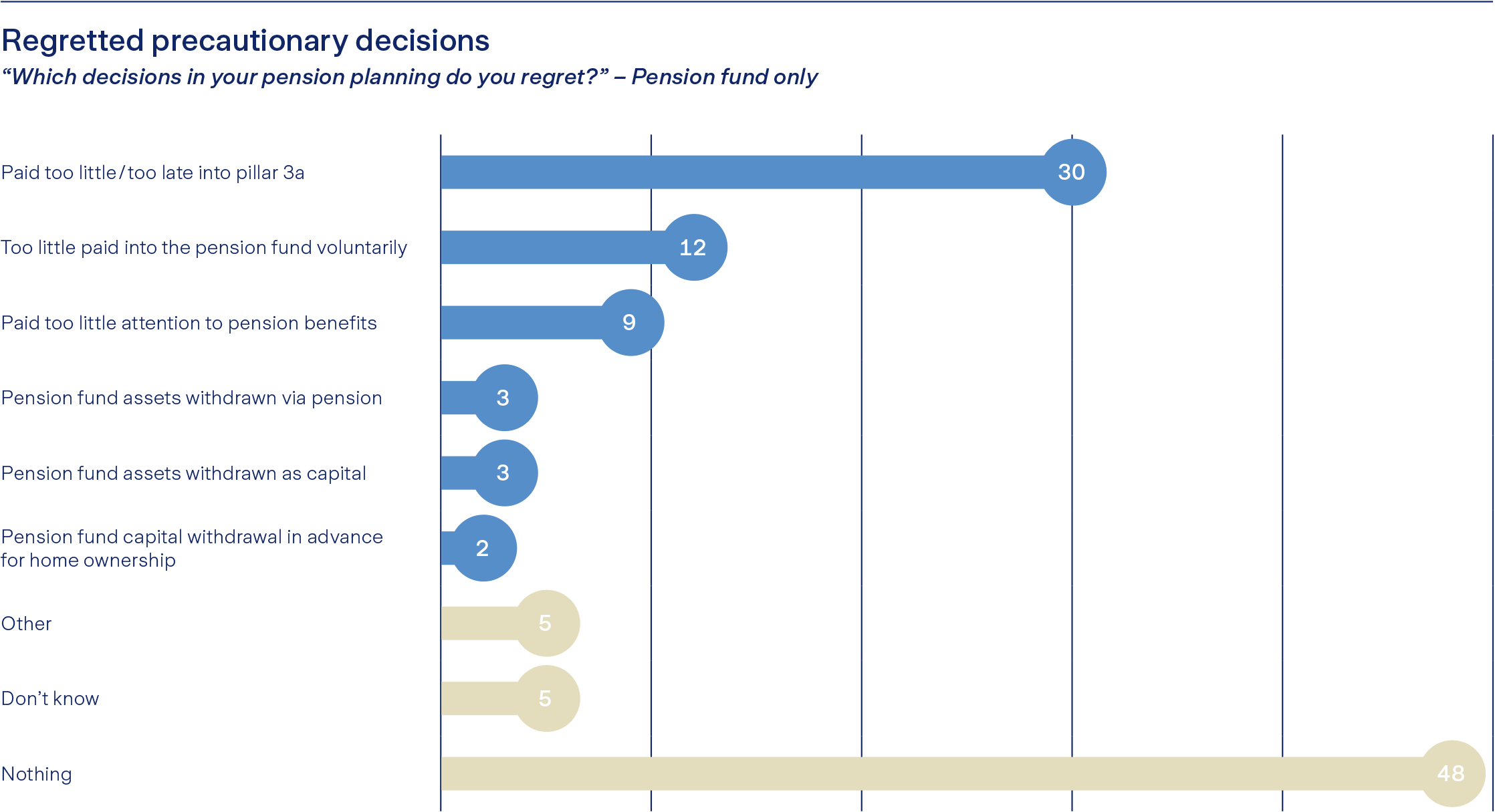

What retirees regret in retrospect

"I wish I had done more in terms of my pension" is a thought that many people in Switzerland have. As part of the "Fairplay" study, retirees were asked whether they regret pension decisions in retrospect. Just under half of them do. The following reasons were mentioned most frequently. 30% said they had paid too little or too late into pillar 3a, 12% regretted that they had paid too little into their occupational retirement provision voluntarily, and 9% paid too little attention to the benefits provided by their pension fund.

Missed pension opportunities in the younger generation as well

These figures should give the younger generation food for thought because the effects of missed pension opportunities often do not become apparent until old age. Nevertheless, 40% of the working population did not pay into pillar 3a last year. In fact, 48% of people aged 18 to 35 are "3a grouches". However, it would be worthwhile for them, in particular, to pay into the 3rd pillar: Thanks to its long term, the compound interest effect comes into play optimally, even if the initial deposit is rather small. In addition, making an early payment also allows you to benefit from tax advantages for longer.

People who know what they are doing invest in shares

In the long term, the expected returns on fund investments are much higher than those on conservative forms of investment, such as savings accounts or bonds. However, knowledge plays a decisive role in the question of whether someone invests their money in shares. 71% of people with good to very good financial knowledge own shares, but only 17% of people with poor to very poor financial knowledge choose this form of investment. These figures show that there is still a great need for information and advice.

Invested in shares? In retrospect, this is usually "just right"

When asked about their investment decisions over the past 10 years, 88% of respondents said they had invested either "just right" or "too cautiously", while only 12% said they had invested "too riskily". Interestingly, those who have invested at least 50% of their savings in shares are the most satisfied: Two-thirds of them say they did it "just right".

Conclusion: Education remains important

Financial security is an important factor for personal well-being. In light of the challenges of the 1st and 2nd pillars, private pension provision is becoming increasingly important. Nevertheless, it has been apparent for years that some people are making retirement provisions too late, with too little money and too little focus on returns. Young people, women, and people with less knowledge of financial topics are particularly affected. This can lead to an increase in social inequalities.

The financial world is called upon to attract less affine target groups to pensions and investments by providing easily accessible offers. Education continues to be important – whether through information events, employee orientations on occupational retirement provisions, or personal consultations.