- What is pillar 3a and why is it so important?

- New from 2026: Pay into pillar 3a retroactively

- How pillar 3a top-up payments work

- Example calculation: How you can benefit from top-up payments

- Tax savings

- Advantages of top-up payments into pillar 3a

- Tips for additional payments

- Useful links

- Frequently asked questions about top-up payments into pillar 3a (FAQ)

What is pillar 3a and why is it so important?

Pillar 3a is the tax-privileged form of private retirement provision in Switzerland. It supplements the state OASI (1st pillar) and occupational retirement provision (2nd pillar) and helps you to strengthen your financial security in old age. Particularly attractive: The amounts paid in can be deducted from taxable income and the capital saved is not taxed as assets. When paid out, the credit balance is taxed separately from other income, using the retirement provision rate.

How do OASI, pension funds and private retirement provision complement each other? And where does pillar 3a come in? Find out more about the three-pillar principle of retirement provision in Switzerland.

New from 2026: Pay into pillar 3a retroactively

What will change?

Previously, payments into pillar 3a were only possible in the respective calendar year. From January 1, 2026, the legislator will allow top-up payments for missed years – up to ten years back. However, this regulation only applies to contribution years from 2025 onward.

Who benefits?

In particular, employed persons who were unable to make any or who were only able to make partial payments into pillar 3a in certain years – for example, due to part-time work, further training, family leave or financial shortages. Now they have the opportunity to close these gaps retrospectively.

How pillar 3a top-up payments work

Prerequisites

- Gainful employment with income subject to OASI contributions in the year in question

- No earlier age-related early withdrawal, regardless of which 3a pension pot you made the withdrawal from.

- Additional payments are only permitted as long as you are still gainfully employed

Conditions at a glance

- Only for contribution years from 2025

- Maximum of ten years back

- The maximum amount at the time applies in each case

- Only one additional payment possible per year

- Additional payment only permitted if the current maximum amount for the current year has already been paid in

Step by step to additional payments

- Check gaps: In which years from 2025 have you paid less or nothing into pillar 3a?

- Research maximum amounts: What was the maximum amount in the respective year?

- Make current payment: Top-up payments are only possible once the payment for the current year has been made.

- Request additional payment: Tell your bank or insurance company which years you would like to pay into.

- Make use of tax benefit: The total of all payments can be deducted from taxable income.

Good to know

No additional payment is possible in the event of periods abroad, longer spells of parental leave or after disqualification in the event of unemployment.

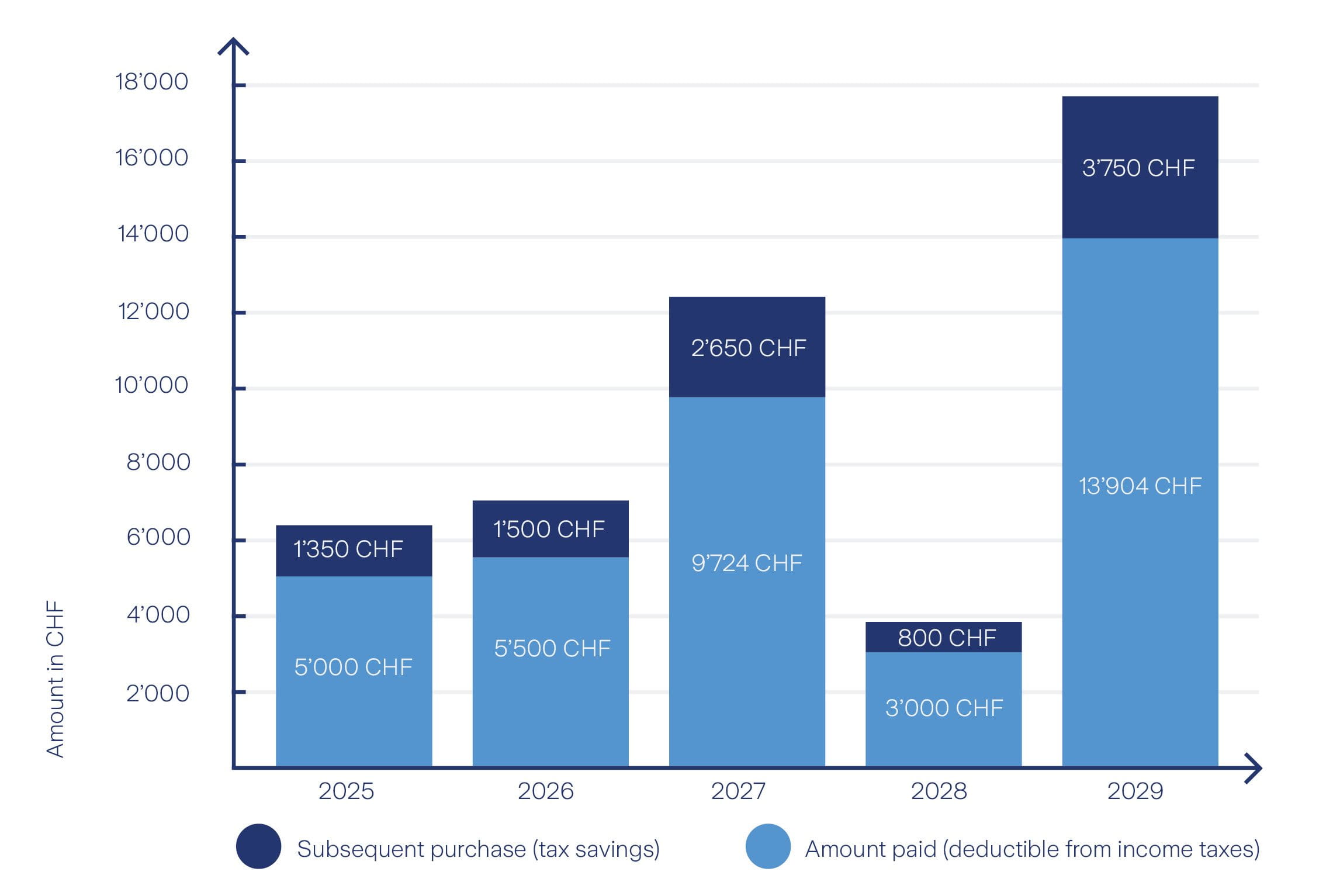

Example calculation: How you can benefit from top-up payments

The following example shows how Ms. Meier catches up on her missed pillar 3a payments in 2027 and 2029. In this way, she closes pension gaps, strengthens her retirement capital and benefits from attractive tax savings at the same time. The figures are for illustrative purposes and are based on assumptions regarding future maximum amounts.

Ms. Meier is 45 years old. In 2026, she did not pay the full maximum amount into pillar 3a. She would like to partially close this gap in 2027 and 2029.

Gaps and additional payments

| Year | Maximum 3a amount | Paid in | Contribution gap in this year | Retroactive top-up payment |

| 2025 |

CHF 7,258 |

CHF 5,000 |

CHF 2,258 |

|

| 2026 |

CHF 7,258 |

CHF 5,500 | CHF 1,758 |

|

| 2027 |

CHF 7,466* |

CHF 7,466 |

CHF 2,258 (for the year 2025) | |

| 2028 |

CHF 7,466* |

CHF 3,000 |

CHF 4,466 |

|

| 2029 | CHF 7,680* |

CHF 7,680 |

CHF 6,224 (for the years 2026 and 2028) |

* The maximum 3a amounts from 2027 are assumptions.

Tax savings

Because Ms. Meier pays in the assumed maximum 3a contributions in 2027 and 2029, she has the option of making payments to close the gaps in 2025 and 2026:

- In 2027, in addition to the assumed maximum amount for 2027, she also pays the additional payment for 2025

- In 2029, in addition to the assumed maximum amount for 2029, she also pays the additional payments for 2026 and 2028

Advantages of top-up payments into pillar 3a

- Tax benefits: Additional payments can be deducted in full from your taxable income – which significantly reduces your tax burden.

- More flexibility: You can close pension gaps from up to ten years back and thus strengthen your retirement provision retrospectively.

- Financial security: Higher retirement capital ensures greater independence and financial freedom in retirement.

- Planning security: You decide for yourself when and how to fill gaps and you can manage your payments in a targeted manner.

Tips for additional payments

- Use additional payments in years when you have a high income in particular – this way you will benefit the most from the tax saving.

- Close the oldest contribution gaps first, as there is the least time left to close them.

- Optimally coordinate additional payments into pillar 3a and purchases in your pension fund in order to make the best possible use of tax advantages.

- There is no three-year blocking period for pillar 3a as with a pension fund – you remain flexible and can withdraw your assets again as a lump sum when due or for certain reasons (e.g. home ownership, emigration or taking up self-employment).

Personal advice: We will find the best solution together

From 2026, additional payments into pillar 3a will offer you new opportunities to strengthen your retirement provision in a targeted manner and save taxes at the same time. However, every life and income situation is individual – and careful planning is particularly worthwhile for retroactive payments.

Our retirement provision experts will help you to identify your pension gaps, develop the optimum top-up purchase strategy and make the best possible use of your tax benefits.

Useful links

Frequently asked questions about top-up payments into pillar 3a (FAQ)

Who can make top-up payments?

Additional payments into pillar 3a are possible from 2025 under certain conditions:

- You are gainfully employed in the year in question and have income subject to OASI contributions.

- You have not made an earlier age-related early withdrawal (from the age of 59 for women or 60 for men) – regardless of the 3a account or product.

- You remain in gainful employment – even beyond the normal OASI age (max. five-year extension possible).

What conditions apply to the additional payment?

- Only for contribution years from 2025: Earlier years (before 2025) cannot be made up.

- Maximum of ten years back: You can pay missed contributions for up to ten years.

- The maximum amount at the time applies. For each year, the maximum amount applicable at that time applies.

- Only one additional payment allowed per year: Multiple additional payments for the same year are not possible.

- Additional payment only with full current contribution: You must have already paid in the current maximum amount for the current year in full before an additional payment for an earlier year is permitted.

How much can I pay in retrospectively?

The maximum pillar 3a amount at the time applies for each year for which retrospective payments are made. You can only make one additional payment per year, but may make additional payments for several years at the same time.

Are there blocking periods?

There is no blocking period for additional payments into pillar 3a as there is with a pension fund. However, additional payments are only possible as long as you are gainfully employed and have not yet drawn any retirement benefits – i.e. have not made an age-related early withdrawal (from the age of 59 for women and 60 for men at the earliest) from one of the pillar 3a pots.

What are the tax advantages?

You can deduct both current and top-up payments in full from your taxable income in the year in question. This allows you to directly reduce your tax burden and strengthen your private retirement provision at the same time.

With professional support from

As a technical expert at Zurich, he contributes his expertise in retirement provision and investments.