When prices rise, so does frustration. We understand that. A number of economic developments influence insurance. In Switzerland, too. What exactly does this mean?

Repair costs rise

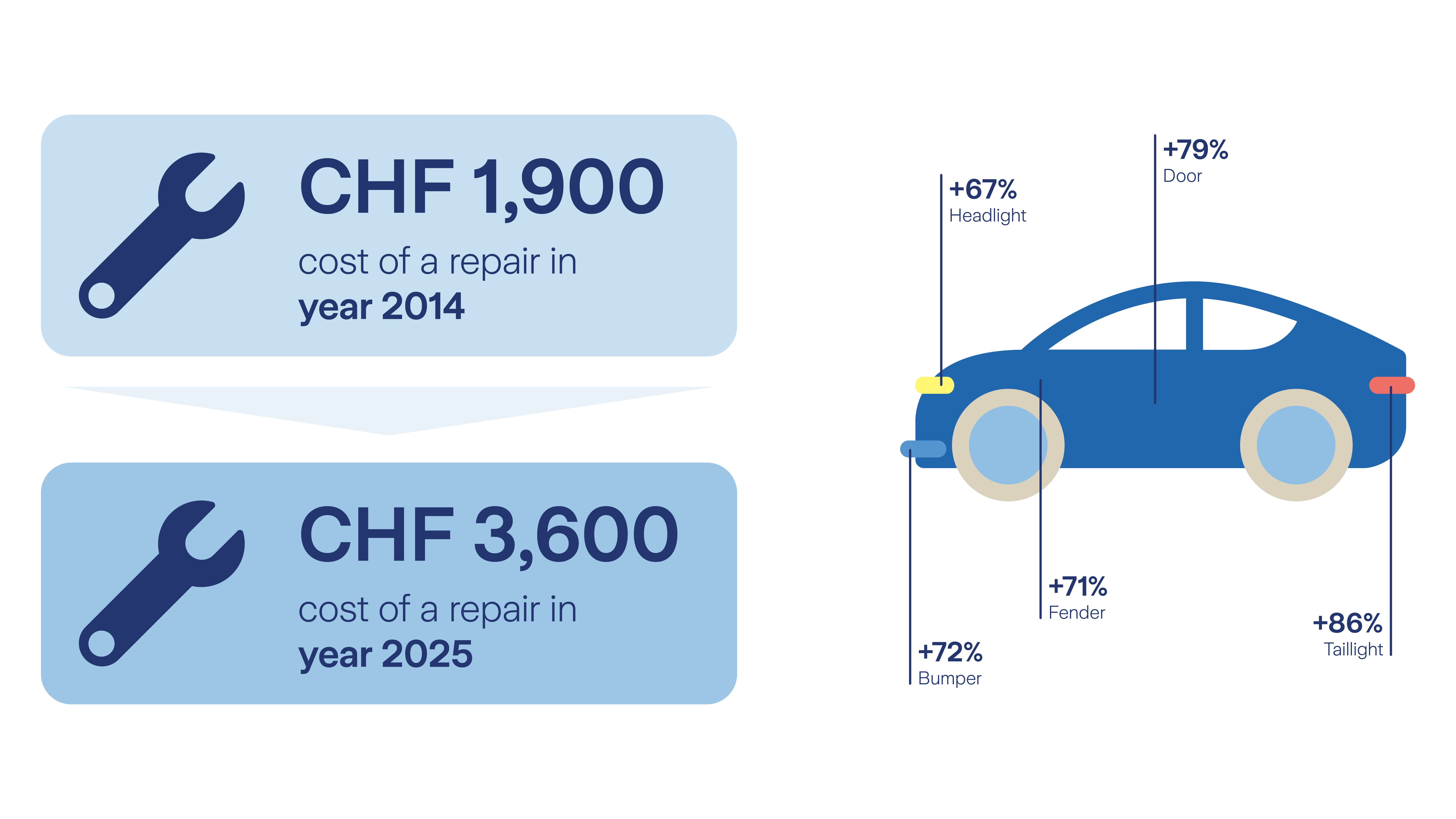

Today, car spare parts imported from abroad are up to 90% more expensive than 10 years ago. The bumper of a car now costs 72% more than in 2014, and a rear light costs 86% more. High-tech components such as sensors and batteries also make repairs more expensive. Around 10 years ago, minor front-end damage to a car often cost less than CHF 2,000.

Nowadays, sensors or cameras are usually also affected, which means that the damage can quickly exceed CHF 3,600. That's an increase of 89% – or significantly more, depending on the car. This trend is continuing, primarily because the technology is becoming more complex and more expensive. This can be seen, for example, in the fact that dynamic LED cornering lights cost more than static halogen headlights. Windshields with an integrated driver assistance system are also significantly more expensive than normal windshields.

Costs of a car repair

In addition to the more expensive material costs, the labor and wage costs of garages have risen. The effects of more complex technology are also noticeable here. As a result, repairs and the replacement of spare parts are becoming more expensive.

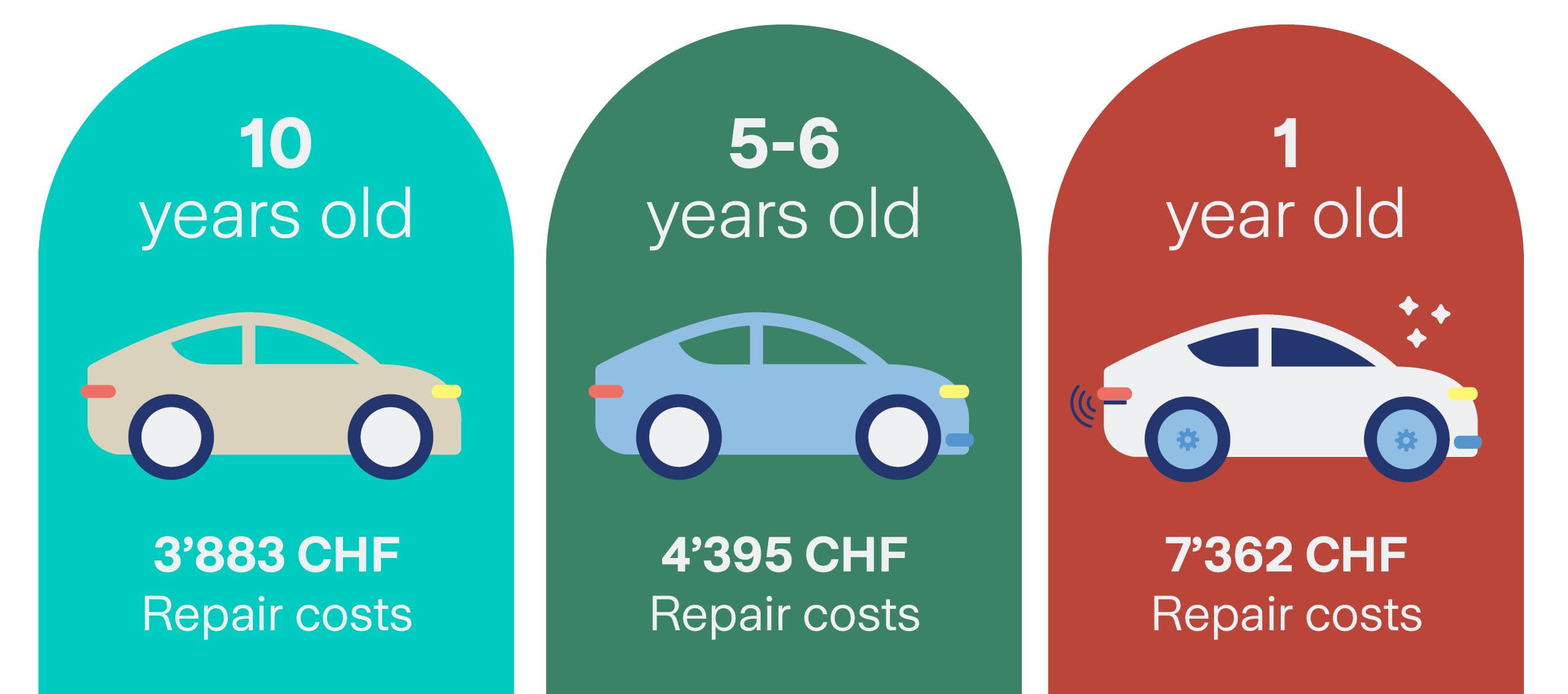

As a study by Comparis from 2025 shows, the age of the car also plays a key role in repair costs. If you have your one-year-old Škoda Octavia repaired today, you will pay significantly more than for the repair of a 10-year-old vehicle of the same model. Further illustrating the point, repairing the new BMW 3 model is around three times more expensive.

Current repair costs using the Škoda Octavia as an example

Severe storms occur more frequently

Changes in the weather have resulted in more extreme precipitation. For example, hail, storms and flooding often cause serious and costly damage to vehicles – including total loss. This concerns not just the major events in the media, but also the flooded garage in the multi-family building next door.

As a mountainous country, Switzerland is one of the countries with the highest risk of hail in Europe. Heavy precipitation and hail are occurring more frequently in extreme forms (Meteo Switzerland). The hailstorms of 2023 in Ticino and 2025 in Appenzell and the St. Gallen Rhine Valley are examples of this trend. Some of the hailstones there were as big as a five franc coin.

We never know in advance whether there will be one big event or many small ones. But we are well prepared: In 2024, for example, we deployed a state-of-the-art hail scanner. Affected vehicles drive through the scanner and within minutes the result is available, which is discussed with an expert on site.

To prevent storm damage, we recommend:

- Follow the weather forecast: Check the weather forecast regularly so that you can take precautions in good time. If required, you can also use an app that warns you of existing storms via text message.

- Park your vehicle in a garage or parking garage in good time. If no shelter is available, you can cover your car with a hail protection cover, for example.

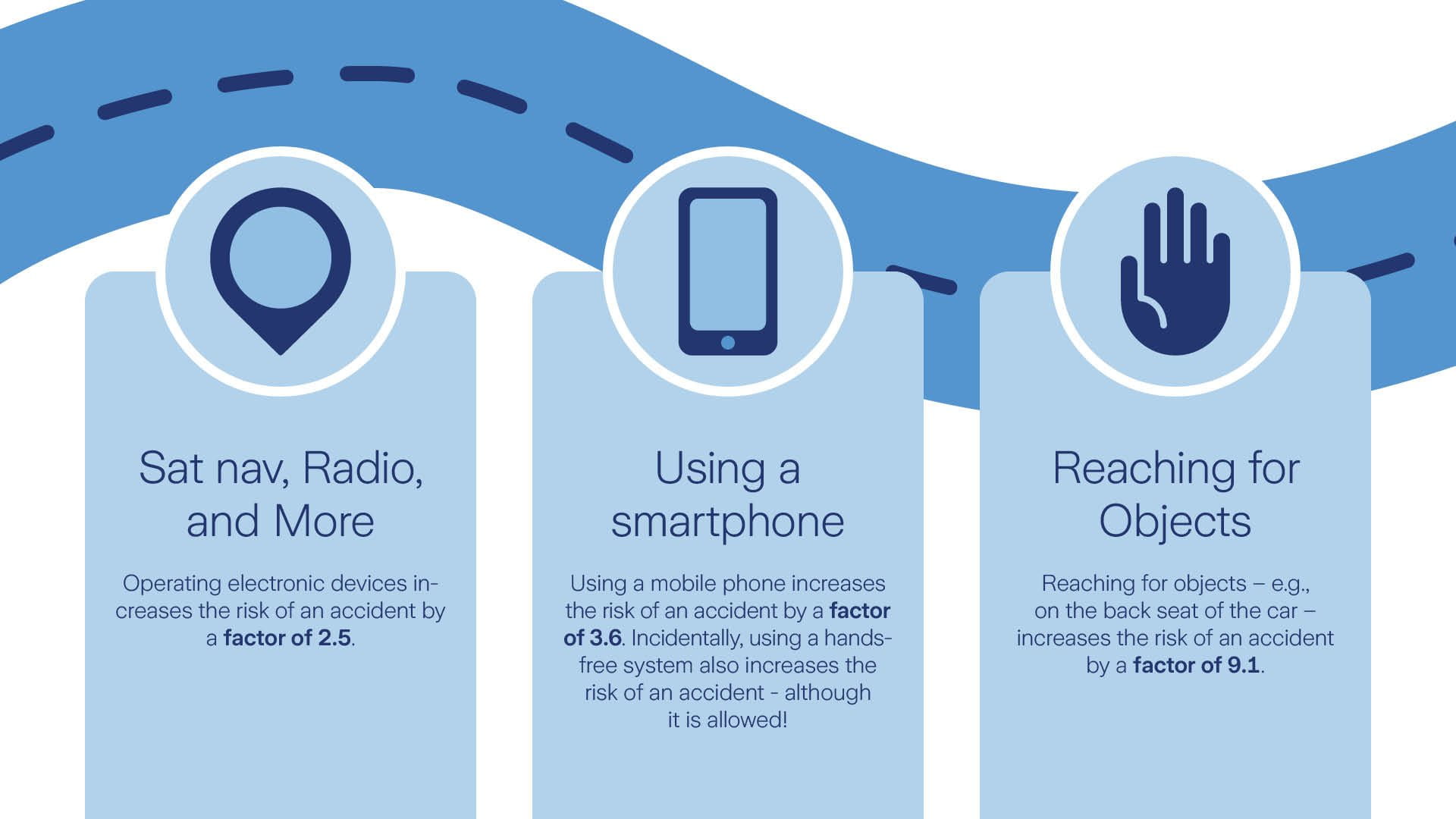

More claims

In addition to storm damage, the number of vehicle damage claims is increasing – from minor scratches to total losses. There are many different reasons for this. They include both increased traffic density and also hectic and distracted driving. Cell phones, navigation systems or radios are more frequently operated while driving. This is distracting and leads to increased claims. It results even more frequently from reaching for objects, e.g. something on the back seat.

How does all this affect my insurance premium?

Insurance companies pay for insured events. They therefore set insurance premiums in such a way that these costs can be covered. This usually involves calculating the average projected damage and the resulting costs. These costs are passed on to the policyholders. If claims costs rise in general, this has an impact on the premiums of all policyholders.

Car insurance: How you can reduce costs

There is often still room to maneuver with existing insurance cover – for example, if the car insurance was taken out a while ago, and it now appears that needs have changed. There could be potential for savings in the following areas:

- Cancel optional cover

Check whether you have taken out supplementary insurance or other services that you no longer need. - Switch from fully comprehensive to partial casco

If you have an older vehicle, for example, partial casco cover may also be sufficient. Switching can reduce the insurance premium. When making your decision, consider not only the value of the vehicle and your individual situation, but also the age of your vehicle. Repairs for newer cars are significantly more expensive, as explained above.

Find out more about switching from fully comprehensive to partial casco - Increase deductible

If you decide to pay a higher deductible than previously in the event of a loss, your premium may be lower. Check which deductible options your insurance company offers and how these affect your premium. - Use interchangeable license plates

If you have several vehicles and they are not driven at the same time, it is worthwhile having an interchangeable license plate. This means that you use the same license plates for two vehicles. To do this, always attach the license plates to the vehicle you are currently driving – the other vehicle may not be put on the road at the same time.